Content

TikTok is a rising power in the world of social media, so any bad news for TikTok is good news for companies like Meta and Twitter. When the company announced Q1 earnings in February 2022, it made headlines by going through the largest single-day valuation drop in US stock market history, losing $237 billion overnight. CFRA analyst Angelo Zino upgraded his price target for Meta from $300 to $350 on Thursday thanks to the expectation the company “will find success penetrating” the text-based social media space. The social media giant, which owns Instagram and Facebook, will debut its new app days after Elon Musk said Twitter would temporarily limit the number of tweets users can read. The rate limits drove users to competing apps like Bluesky, the app backed by Twitter co-founder Jack Dorsey, which experienced « record-high traffic » on Saturday.

At the current market cap of $560.27 billion, META looks undervalued compared to the largest companies in the S&P and its peer group, in addition to over 30 analysts projecting EPS increases for 2023 and 2024. I don’t believe the rally is over, and if the market ends up turning bullish on a Fed pivot in 2023, shares of META could benefit even more than I believe they already will. On the one hand, the move to the metaverse expands its total addressable market, which could keep revenue growing for more than a decade. On the other hand, some investors are worried about the resources in time and capital that Meta Platforms could allocate to the project with uncertain outcomes. Nevertheless, the company’s core social media business is experiencing robust user and revenue growth at a massive scale.

Exacerbating the problem for Meta, Apple last Fall changed its privacy policy for apps on its devices, making it more difficult for Meta to track user activity on mobile devices like the iPhone and iPad. The adjustment means the advertising Meta sells its partners is less targeted to the users that advertisers want. Until Meta can find a workaround, this will be a significant headwind as evidenced by Meta’s report of a potential $10 billion drop in annual ad revenue that is tied to the privacy change. The Federal Reserve has started raising interest rates to counter rising inflation, a move that hurts growth stocks more than average. Additionally, Meta faces headwinds from Apple’s (AAPL 0.90%) privacy changes and increasing competition. Finally, rising competition from ByteDance’s Tiktok and other social media sites is slowing user growth and engagement.

Meta, which owns Facebook and Instagram, teased a new app called Threads that is set to take on Twitter for real-time digital conversations. Meta sacked 11,000 employees (13% of its workforce) in November of last year amid pressure from large investors to shore up margins. Some of those cuts go as deep as canning cafeteria workers (see the tweet below). CEO Mark Zuckerberg says the company is just beginning its cost-cutting journey, much to to the delight of the Meta bulls. In this market, the last thing investors have been rewarding this earnings season is a bottom-line miss vs. expectations of any magnitude. Part of it may be the realization of the savings CEO Mark Zuckerberg was looking for when Meta announced layoffs in November.

Meta Platforms Stock Is Rising Again: Here’s Why It’s a Buy

The seven-largest companies in the Nasdaq 100 account for 55% of the index. It’s also likely that there may be notable relative weighting shifts within these seven giants. Meta is definitely the “disaster du jour” but there remains value in its data centers and global business. Facebook, Instagram, and WhatsApp are still primary communication media platforms in the developing world.

United States lawmakers are pushing the current administration for a full-scale ban on TikTok which would impact more than 100 million monthly active users in the United States. Hypothetically if this occurs, META should pick up a significant percentage of these users, making advertising on the platform more enticing. META builds technology platforms that help people connect, share, find communities, and grow businesses. Anyone who allocates resources toward advertising wants the highest penetration rate and the most exposure possible. The main reason why META drives over $100 billion in advertising revenue annually is because they provide an outlet where billions of eyeballs can be reached.

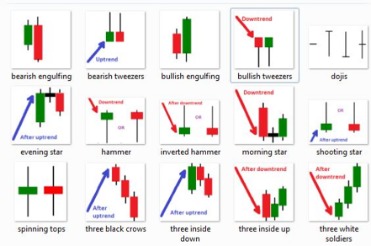

Our Most Popular Articles

In Twitter’s earliest days, Mr. Zuckerberg offered to purchase the company, but was rebuffed. Before the 2016 U.S. presidential election, Facebook also made a major push to feature its live products and trending topics in political events and on television. Meta executives previously characterized the app as a “sanely run” version https://g-markets.net/helpful-articles/hammer-and-inverted-hammer-candlestick-patterns/ of a public-facing social network, in a not-so-subtle jab at Mr. Musk’s erratic behavior. On Monday, his company, Meta, which owns Facebook, Instagram and WhatsApp, teased a new app aimed squarely at Twitter’s territory. « The $40 billion increase in the share repurchase authorization provides additional EPS support, » Thill said.

- Second, Meta’s Reality Labs segment, responsible for developing the metaverse, lost a whopping $10 billion in 2021.

- To put that in perspective, Wall Street’s revenue estimate is sitting at $29.53 billion.

- That means the increase in time spent will fully offset the lower monetization rate for Reels.

- But the move has been greeted skeptically, given that the metaverse is far from mainstream.

While Meta may not have been recognized as an AI leader in recent events, its vast user base and open software position it to potentially become a significant player in the field. The metaverse can potentially change the way we interact socially and even how we do our jobs. Meta Platforms envisions users existing as virtual avatars of themselves, surrounded by a self-sustaining digital economy that could feature all the popular brands we engage with in the real world. So, Meta Platforms can easily exceed $1 trillion in market capitalization by 2030 and become worth much more than that. That’s why it would be a smart idea to use Meta stock’s drop and buy it for the long run as it is trading at less than 15 times earnings right now. So, Meta Platforms can unlock an entirely new advertising opportunity with the metaverse, where marketers can spend money on ad space within the virtual world.

Motley Fool Returns

These include the implementation of widescale layoffs, as well as the company’s scaling back of its metaverse plans. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. We’re committed to giving you more control over your audience on Threads – our plan is to work with ActivityPub to provide you the option to stop using Threads and transfer your content to another service. If you have a public profile on Threads, this means your posts would be accessible from other apps, allowing you to reach new people with no added effort. If you have a private profile, you’d be able to approve users on Threads who want to follow you and interact with your content, similar to your experience on Instagram. Other platforms including Tumblr have shared plans to support the ActivityPub protocol in the future.

META shares are moving on Wednesday as the stock continues to climb following the release of the company’s new app, Threads. It has fallen significantly from its previous highs but remains a behemoth in the world of social media. That could mean right now is the time for interested investors to buy in at a discount. Its stock price started the year just over $120 and rose to a peak around $128. This roughly 6% increase outpaces the S&P 500, which has held relatively steady year-to-date.

The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines. One estimate suggests the metaverse will be worth $800 billion in 2024, growing at 13.1% each year, which could mean a $1.6 trillion annual value by 2030. Another estimate suggests it could be worth up to $30 trillion over the next 10 years. Either way, it makes the $10 billion Reality Labs loss look like a drop in the ocean by comparison.

More Thursday Stock Market News

For starters, economic conditions, which have negatively affected digital advertising demand since last year, could normalize over the next few quarters. This alone could get Meta Platforms back to its high-water mark of profitability. In 2021, the company reported earnings of $13.77 per share, versus $8.59 per share reported for the full-year 2022.

The First Trust Nasdaq 100 Equal Weighted Index ETF (QQEW), which gives an equal weight to all 100 stocks, is up just 18.8%. Google stock has a 7.4% weighting with the GOOGL and GOOG share classes combined. Market valuation is the largest factor, but with methodology to limit overconcentration. As of now, your Threads username appears the same as your Instagram username.

That means the increase in time spent will fully offset the lower monetization rate for Reels. That’s an effort the company began in earnest at the start of the year. Meta is clearly facing headwinds and it will be a challenge to overcome them, but the relative bargain valuation suggests these headwinds are already priced into the stock.

Developers can build new types of features and user experiences that can easily plug into other open social networks, accelerating the pace of innovation and experimentation. Each compatible app can set its own community standards and content moderation policies, meaning people have the freedom to choose spaces that align with their values. We believe this decentralized approach, similar to the protocols governing email and the web itself, will play an important role in the future of online platforms. This is above the $27.66 billion that analysts were looking for this quarter. It’s also a 3% increase compared to the $27.91 billion reported in Q1 2022. Over the past year, META stock has surged 37%, outperforming the S&P 500 index, which has only risen 2.5%.

Financial Calendars

My preference is to base my valuation model on FCF as the profitability measure because, unlike net income, it can’t be manipulated through write-offs, write-downs, and other GAAP accounting practices. FCF is simply deducting capital expenditures from the cash generated from operating activities. How much cash a company generates from its operations is much harder to manipulate than net income because $1 of cash from ops should always equal $1 of cash from ops. To determine what I believe the fair market value is, I start with the total equity of a company. This is my baseline because if a company was to dissolve itself, theoretically, the total equity is what would be left for the shareholders to chop up among themselves after all liabilities are zeroed out. After the baseline for total equity is established, I look toward profitability.